Liron Brish – October 14th, 2021

The carbon offset market is estimated to be $300 billion by the end of this decade. Nearly every week brings another net-zero pledge by a country or country-sized corporation, making the gap between 2030’s estimated market size and 2018’s $300 million market value continuously smaller.

Agriculture expects to play a significant role in this market through soil carbon sequestration, the process in which carbon dioxide is removed from the atmosphere and stored in the soil. While soil carbon has long been a popular topic in regenerative agriculture, its advocacy is now led by agricultural financiers, and the optimism that began at industry conferences now spreads all the way to the independent farmer.

But these conversations in agriculture have been myopic, ignoring the open market competition from offsets created by the energy, manufacturing, and mining industries, among others. Consequently, soil carbon offsets account for less than 1% of all offsets today. Looking forward, 1% of a future $300 billion market creates just $3 billion value for a multi-trillion dollar crop industry.

Even that unremarkable estimate is optimistic as it incorrectly assumes that all carbon offsets are created equal. Carbon offsets are not fungible commodities, however, and as market liquidity and transparency increases, a very clear value spectrum will emerge for various offsets.

Other industries’ offsets hold two key advantages over agricultural offsets: permanence and accuracy. Without addressing these issues, soil-based carbon offsets will settle at the lower end of the value spectrum and risk becoming the market’s equivalent of junk bonds – potentially high-yielding but eventually imploding under a little market stress.

Permanence refers to how long carbon is stored, with longer durations favored in order to match or exceed carbon dioxide’s 300 to 1,000 year atmospheric life. Agricultural offsets possess a natural disadvantage when it comes to permanence as these offsets often offer just 10 years of sequestration. A high risk exists of not adhering to even that short duration – just one tillage pass can release carbon that took years to sequester back into the atmosphere. Compared to permanence in mining, for example, where storage can last hundreds to thousands of years with minimal risk of releasing carbon back into the air, soil carbon offsets are decidedly an inferior product.

With a fundamental permanence handicap, agriculture must avoid decisions that could further erode its offsets’ market value. The industry is at a critical decision-making point when it comes to the accuracy of its offsets. Accuracy refers to how closely the carbon offset sold reflects the actual carbon stored.

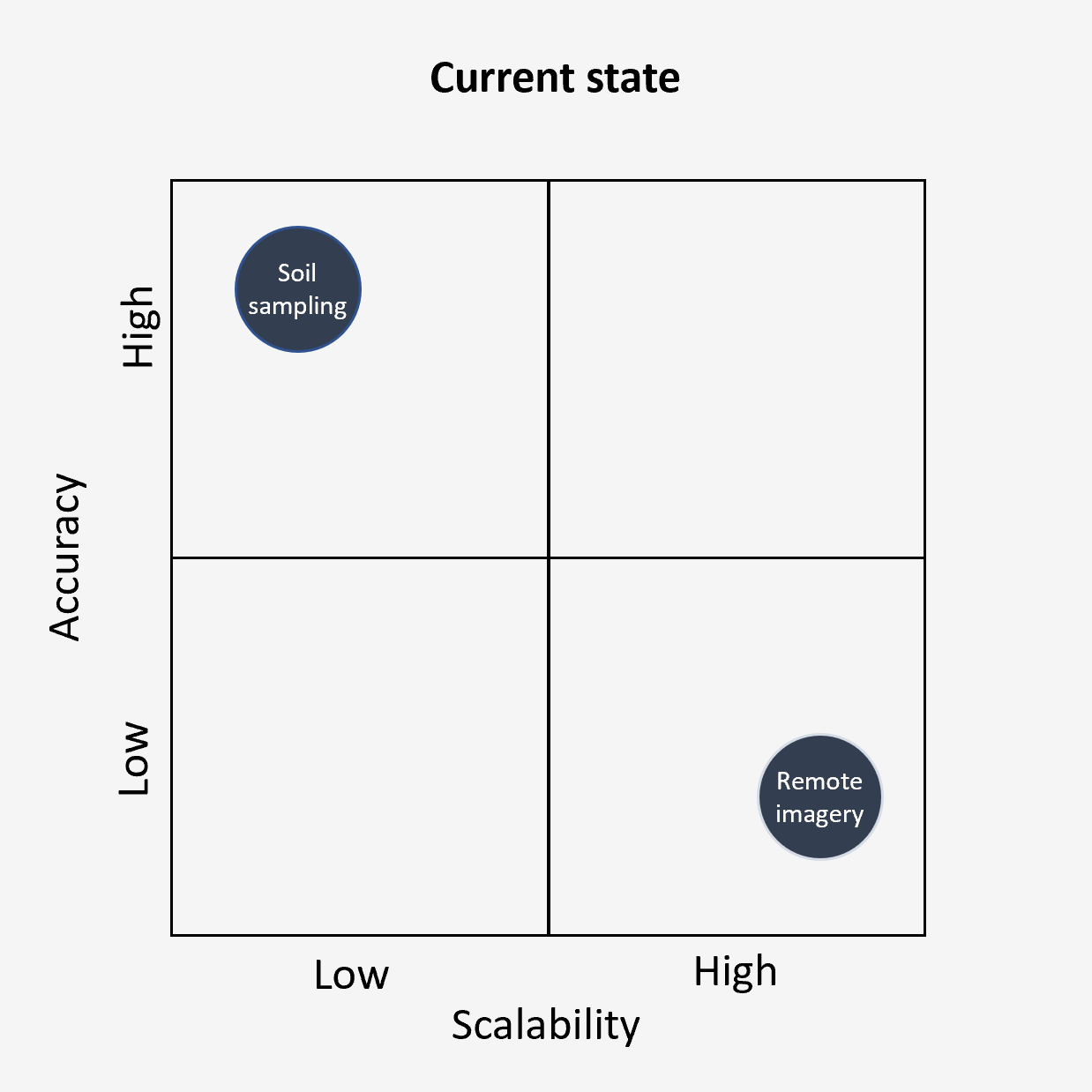

The most accurate method for measuring soil carbon is through direct, in-situ soil sampling. The least accurate method today is through practice-based, remote imagery-driven models. The latter has become the preferred method in agriculture today.

The logistics of soil sampling has not changed much in decades, making it notorious for being a laborious, time-consuming, and difficult to scale process. It is no surprise that the new market seeks a more scalable solution.

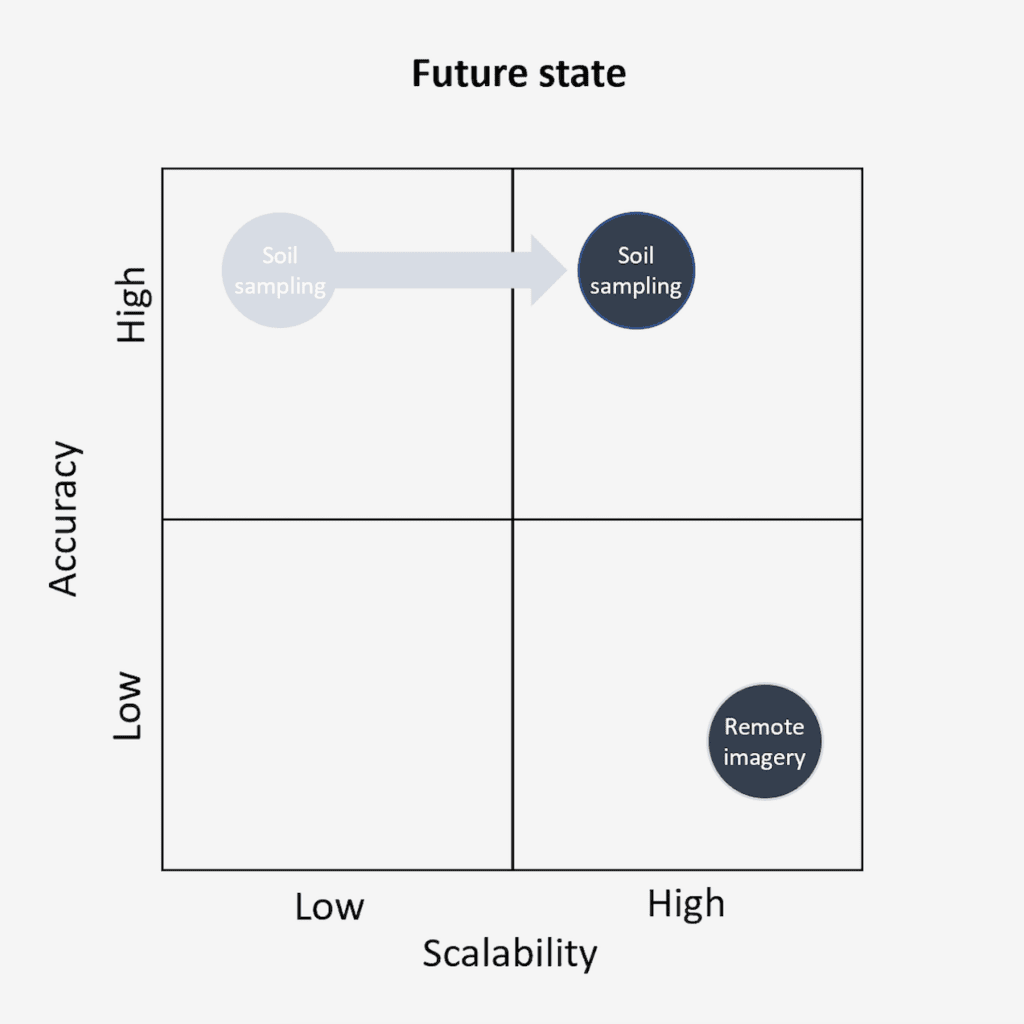

Ramping up efforts can take two forms. The first is process optimization – making boots-on-the-ground more efficient and data flow more seamless. The second bypasses the process altogether with remote imagery and modeling.

Scaling an inaccurate output is the wrong decision. The first wave of agricultural technology investment went towards scaling deficient agronomic insights that neglected heterogeneity in soil, avoided hyperlocal differences in weather, and conveniently ignored the lack of relevant data. The results of hundreds of millions of investment dollars were a nice-to-have tool instead of automated agronomic decisions as promised.

The industry is making the same hubristic mistake when it pushes remote imagery modeling over in-the-field solutions. These models are inaccurate – some with 50% margins of errors – and offering them in the markets today establishes a negative perception of soil-derived offsets. For example, many of these models rely on foundational data such as the US Department of Agriculture’s SSURGO (Soil Survey Geographic Database), a soil database amassed by “walking over the land and observing the soil” and collected at a scale of 1:12,000. While good enough for academia, this becomes toxic in carbon markets when compared to more accurate options.

Instead of putting forth substandard offsets in the market and destroying the future potential for agriculture, let us optimize the process of in-field soil sampling. We can improve dispatch and engineer more efficient navigation routes for soil technicians as opposed to today’s “choose your own adventure.” We can make data transparent and shareable as opposed to today’s pdf and excel dominated communication. We can empower every independent agronomist with the tools she needs to be a part of the new carbon economy. We should augment soil sampling with models, but we will not replace it.

It is important to recognize that the competition in carbon offsets will not be intra-industry nor will it be won by organizations that can claim the most acreage. The real competition will be waged against industries whose offsets enjoy natural advantages over ours. If agriculture wants to be a player in the future carbon world, we must aim for accuracy and scalability and that requires doing hard work on the ground. Luckily our industry has never shied away from that.